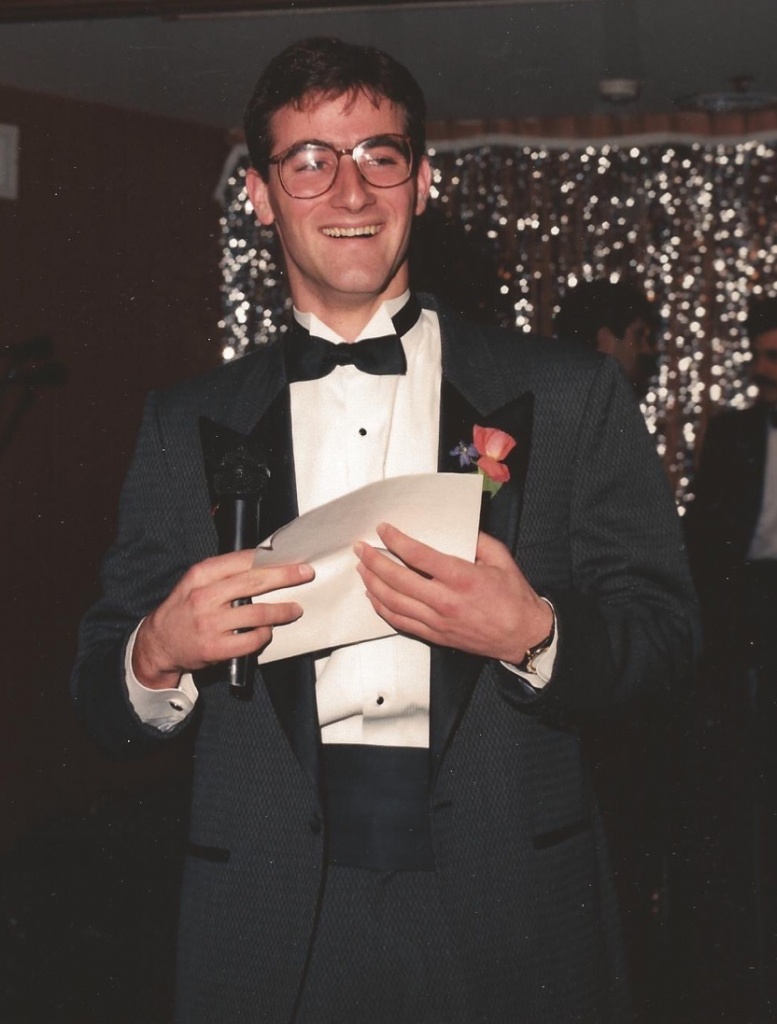

Jeff was born on January 7, 1967 in the Bronx, New York and grew up in Los Altos, California.

He graduated from University of Pennsylvania in 1989 and worked in New York at Goldman Sachs as a financial analyst. He was interested in business and especially in Israel and was planning to work in the United States, and raise money for Israel. When he died in a plane crash on July 22, 1991, he was 24 years old and on his way to Los Angeles to participate in a four week program at Brandeis-Bardin Leadership Institute (BCI) that he felt would be helpful to him both personally and professionally. He became more interested in Jewish studies as a young adult and began taking Talmud classes in New York.

During college Jeff took a semester abroad in Israel studying at the Hebrew University in Jerusalem and the following summer he joined the Israeli army for a 10 week rigorous training program called Marva. He said that his army training was one of the most meaningful experience he ever had.

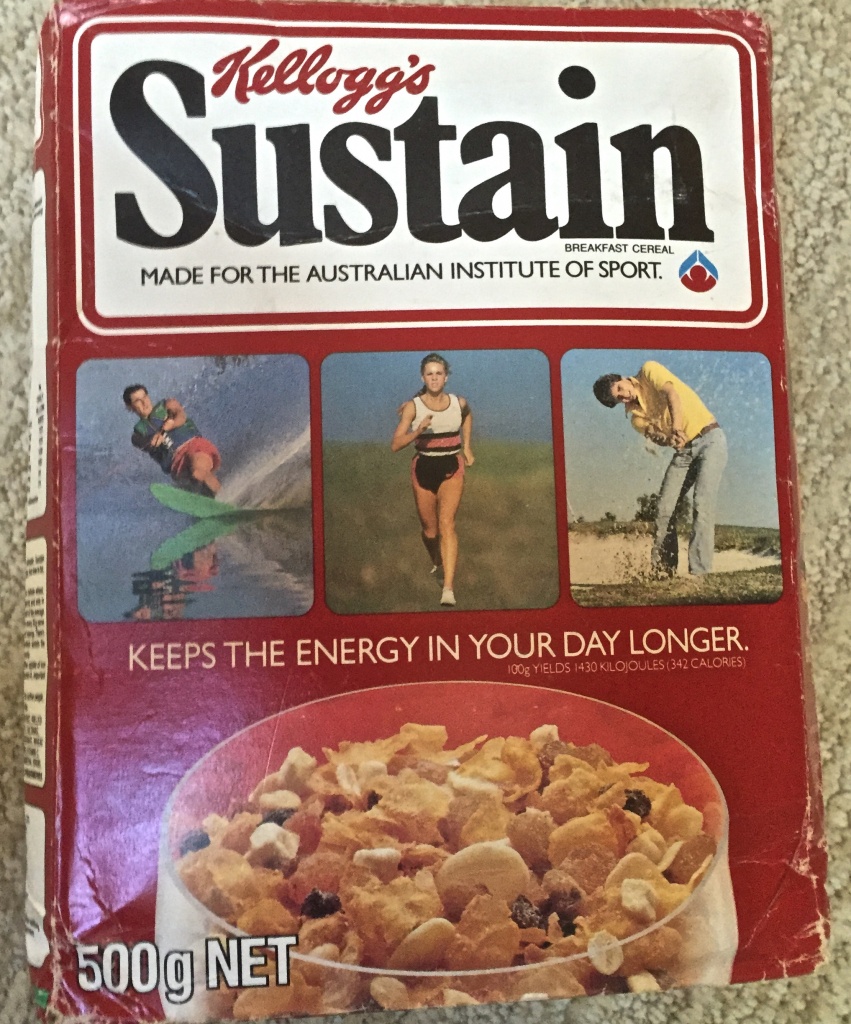

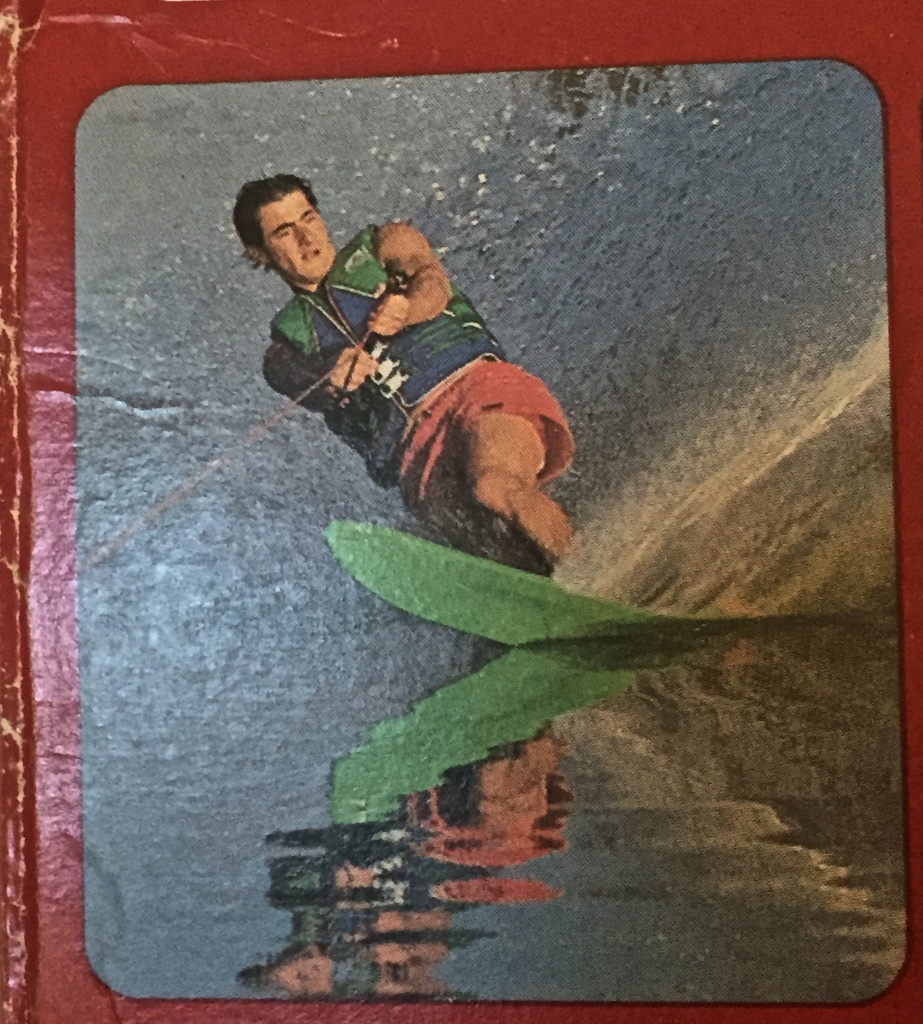

Growing up, Jeff was a natural athlete and participated and excelled in many sports. He loved tennis, baseball, soccer, snow skiing and waterskiing and had a tremendous amount of confidence and initiative, always challenging himself with new experiences. He was involved in his temple’s USY (University Synagogue Youth) program, attending national and international conventions. While attending Homestead High School he searched for a professional photographer to take pictures of him waterskiing at dawn in hopes that these pictures could be sold. He did actually appear on the front of a Kellogg’s Sustain cereal box in Australia (see photo below).

Jeff had a great sense of humor and was quite social and popular, known for being an especially kind, caring and fun person to be around. He kept in touch with his friends once he left home, was a good listener, problem solver and devoted friend. He was intellectually curious and loved learning about people and encouraging them to talk about themselves. We all miss him dearly.

An article written by Jeff:

Rite of passage: teen tangles with the IRS

By Jeff AstorSpecial to Los Altos Town Crier Extra (1982)Bewilderness struck me when I discovered that the Internal Revenue Service planned to audit our private family foundation. My sister and I preside as trustees of the foundation, which was initiated for charitable purposes. As I had assumed the financial and managing responsibility, I was the target for the IRS. Ron Clark, a mild-mannered IRS man, seemed fairly pleasant over the phone, allowing me to alter the date and the time of the audit, which was conducted at my home.After rushing home from school, I was surprised at the outset by Clark arriving five minutes early. Why I didn’t expect him to be on time, I don’t know. The IRS always seems to mail tax forms on time, if not early. I wonder why…..In any case, we sat sown at the table and he began to talk, eventually he came to the reason for the audit – until then I hadn’t a clue.Supposedly, our tax-exempt organization owed some taxes. I found this to be a bit contradictory and I had written a letter in appeal. It was this “claim,” as the IRS labeled it, that led to the legal investigation.“Under Section 4940 all private foundations are required to pay a 2 percent excise tax,” Clark said simply.I told him that I was unaware of the tax and then asked whether we were considered a private, tax-exempt foundation for charitable purposes.“Yes,” he said, pointing anxiously at the paragraph in his little code book, “But according to Section 4940, there exists a 2 percent excise tax on all income from interest or dividends.”“So technically,” I said ‘we are not tax-exempt because the foundation cannot evade the 2 percent tax”.He agreed.On the topic of the market value of our assets., I explained that we owned stocks and had the rest of our money in a savings account. Clark asked how I determined the market value of the stocks.I looked at him in puzzlement. I was sure he knew how the value of stock is determined. Since I probably didn’t appear old enough to drive, he must have been testing me.“The day I file the return I look at the stock market to check the current value of the stocks,” I answered. “And how do you know the value?” he persisted.I explained the complex process of taking the current price for each of the stocks, multiplying it by the number of shares we owned of each and adding these figures together.His forehead crinkled and he seemed to be in deep thought, as if enlightened by something.The clock ticked away, approaching a time when I usually do what any normal high school kid would do — homework. Unfortunately, he and I were still at the kitchen table, talking about the foundation’s 1982 tax return. Two and one quarter hours later, the audit was over. Although all my information was sufficient and well-organized I had lost. The man from the IRS had forced me to bear the burden of the $17 tax and the $2.50 penalty.